Our process combines state-of-the-art technology with an easy-to-use interface to deliver a simple and powerful investor experience.

Get StartedOur investor

community has

funded

Individual Merchant

deals on

the platform

LNS users

have invested

on the platform

Offers direct access to investment opportunities within the Small Business Finance asset class to retail and institutional investors.

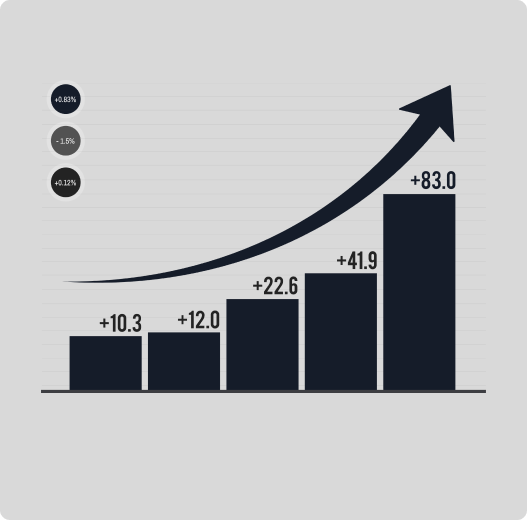

We’ve bridged a massive gap in the market to create an investment opportunity previously unavailable on such a broad scale.

Since inception, LNS Capital Partners has funded over 45,000 investments representing over $5M in Total MCAs dispersed to end businesses.

From start to finish, learn all the intricate steps of the lifecycle of an investment on our platform

LNS works with originators performing a detailed underwriting process. The process takes a methodical and systematic approach in order to admit an originator onto the platform. is constantly looking for partners that can enhance the quality of our platform and our investors long term goals.

The investment team conducts an extensive review and analysis of the investment opportunity. The process typically will take several months before a potential originator will be presented to the investment committee for approval and onboarding.

If an originator is recommended by the due diligence team for approval the next step includes a presentation to the investment committee.

The investment team conducts an extensive review and analysis of the investment opportunity. The process typically will take several months before a potential originator will be presented to the investment committee for approval and onboarding.

If an originator is recommended by the due diligence team for approval the next step includes a presentation to the investment committee.

Discover a high-yield, diversified investment opportunity with our Self-Directed Business Funding platform. Ideal for accredited investors seeking alternative assets—contact us today to learn more.